Not known Factual Statements About Flood Insurance on the Gulf Coast - Pyron Coastal Insurance

The Basic Principles Of Best Flood Insurance Providers • 2021 Quotes • Benzinga

Do I require flood insurance? If you live in a location at high risk for floods, flood insurance coverage might be needed by your lender. Enter This Is Cool to determine if you live in in a high-risk zone in the United States. Think due to the fact that you don't live near the coast that your home is safe from flooding? The truth is, floods can occur anywhere.

MyFloodInsurance.com Partners with Top-Rated Flood Carriers to Provide Direct Access to Instant Quotes

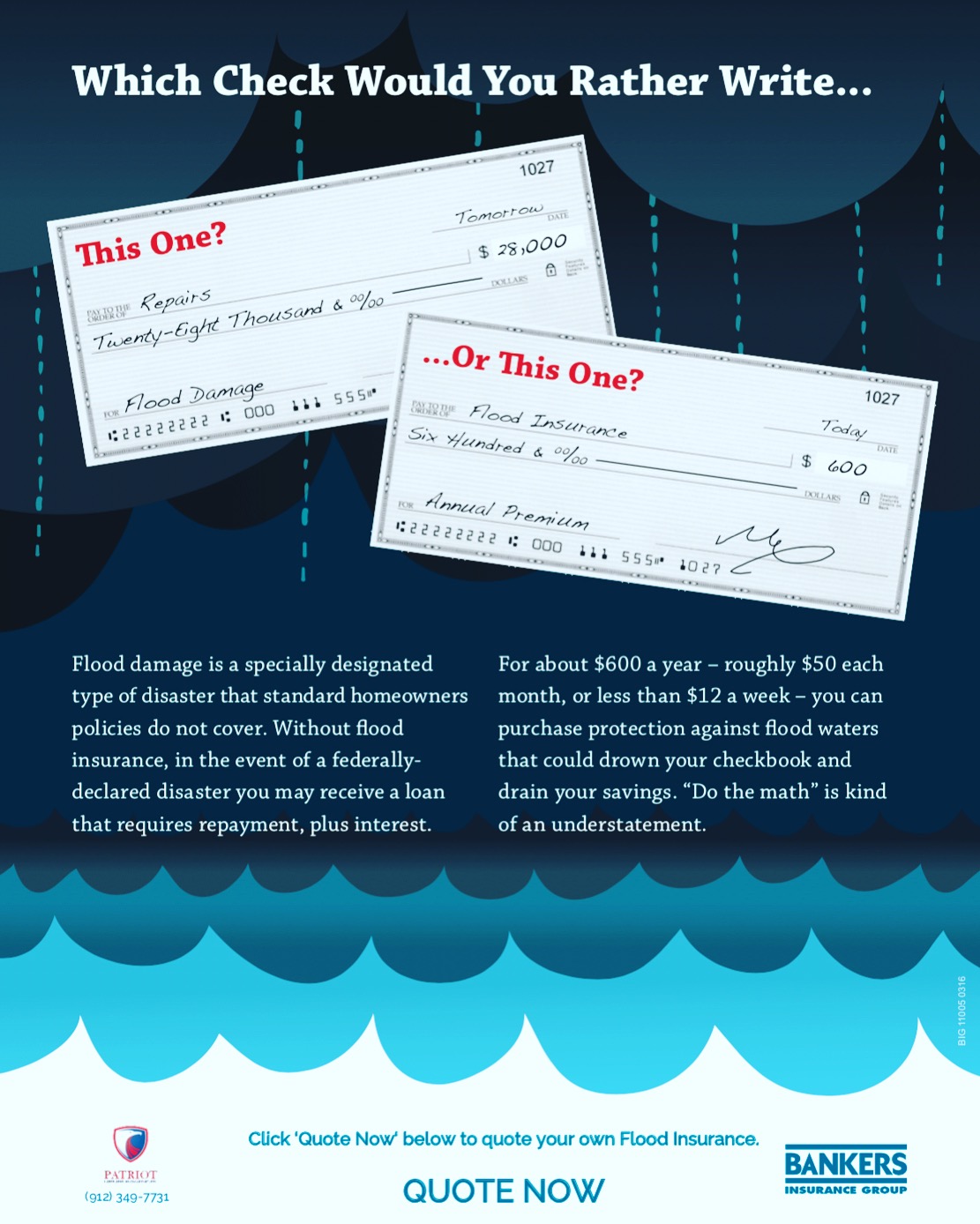

Something else to consider, the majority of property owners insurance coverage policies do not cover flood damage. Water does not wait and neither need to you. Find out more about Flooding in America to assist figure out if you require to think about getting a flood insurance quote. When should I purchase flood insurance? Buy flood insurance prior to a flood threat is approaching.

Exceptions include if you have actually acquired a brand-new home and the closing remains in less than 1 month.

Reasons Why Flood Insurance is Essential

7 Simple Techniques For Florida Flood Insurance - Private and NFIP Flood Coverage

You might not be fretted about damage from flooding due to the fact that you don't live near the coast or another body of water. Or possibly you assume your home is already covered for water damage by your property owner's insurance plan. The truth is that flooding does take place, and you need to be prepared if it does.

Your house owner's insurance does not cover damage brought on by flooding. A different policy must be purchased through the National Flood Insurance Coverage Program. Your Farm Bureau Insurance coverage agent can assist you with buying a flood insurance coverage for your home. Our agents can also address questions you may have about an existing flood policy.

Due to the fact that all it takes is a few inches of water to harm your home and its contents, it is necessary you are covered. Considering that house owner's insurance coverage does not cover flooding, it is very important to have protection from poor drain systems, quick build-up of rains, snowmelt, and broken water mains. What Flood Insurance Coverage Covers A flood insurance coverage policy uses protection for both the structure (your home) itself and your individual property, consisting of furnishings, electronic devices and other items that can be harmed by flooding.

Flood Insurance - Alabama Insurance Agency

The Ultimate Guide To Flood Insurance - Amica

Coverage is restricted up to $250,000 on the structure itself, and contents protection is restricted approximately $100,000. If you need additional protection, you may acquire an excess flood policy. Your agent can assist you get a flood insurance coverage through NFIP and an excess flood insurance coverage to make certain you have the ideal quantity of coverage.